Housing Needs in the Region

In the North Tahoe-Truckee region, there is a need for housing at every income level, from homeless to middle-income salary earners.

In 2016, BAE Urban Economics, an award-winning urban economics and public-benefit real estate development consulting practice, was contracted to create the Truckee North Tahoe Regional Workforce Housing Needs Assessment.

- Read the full report (424 pages)

- Read the Executive Summary (18 pages)

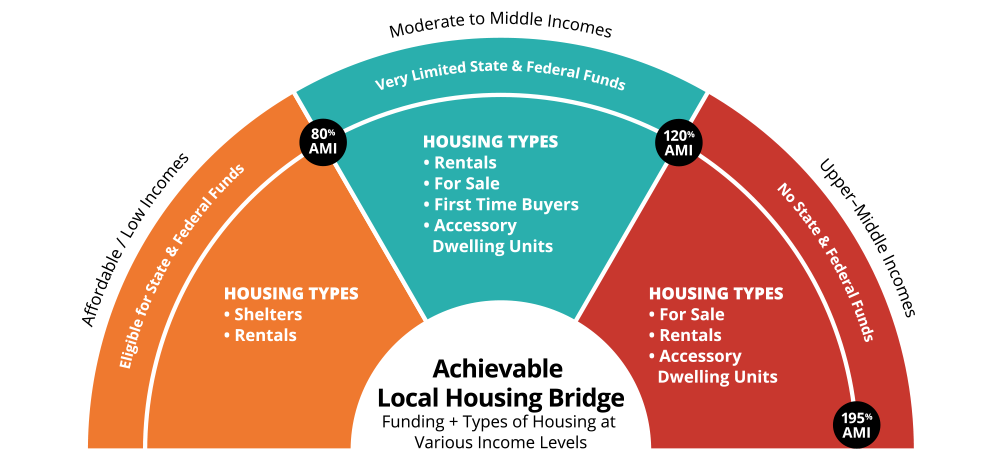

Achievable Local Housing Bridge

The Mountain Housing Council’s goal is to help more people understand that there is a gap between affordable housing programs and available housing in the North Tahoe-Truckee region. People who fall into this gap make too much to qualify for affordable housing developments but too little to buy or rent market-rate homes.

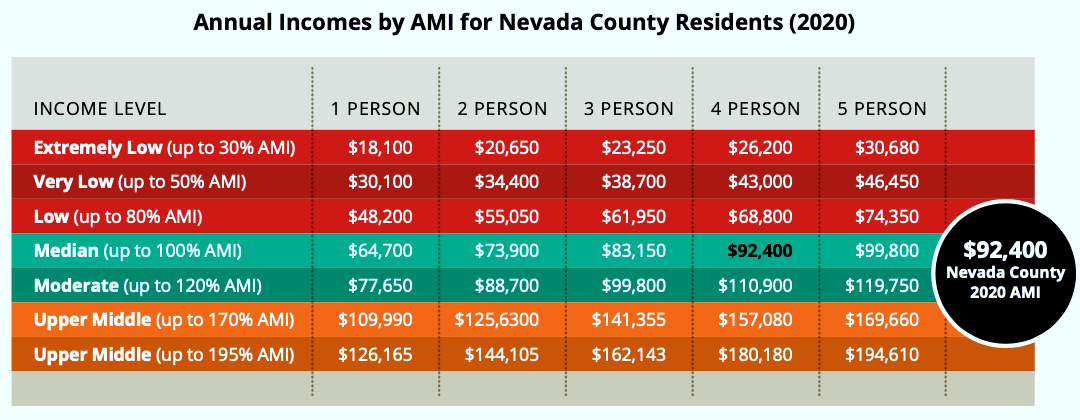

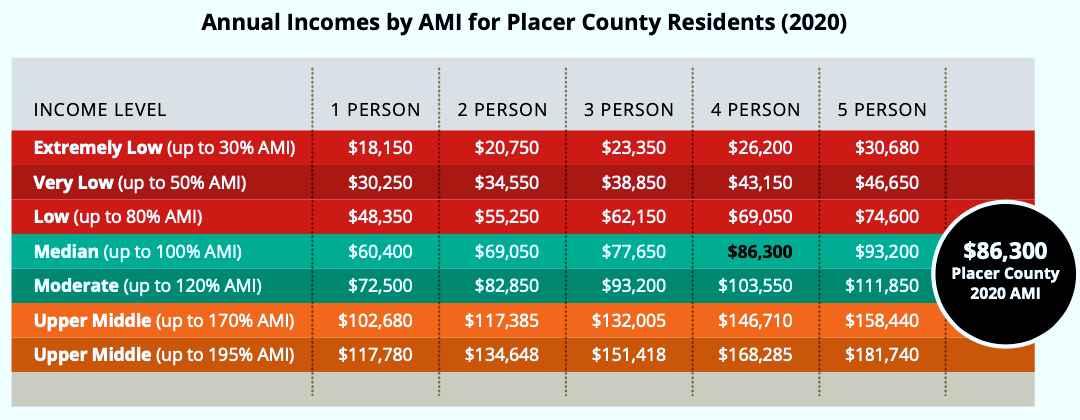

Understanding Area Median Income

Area Median Income (AMI) is the household income for the median — or middle — household in a region. The US Department of and Urban Development (HUD) publishes this data annually for regions; data varies by household size. The following illustrates the dire need for housing.

The California Department of Housing and Community Development (HCD) makes minor adjustments based on regional factors to these numbers prior to publishing. Exact household AMI is determined by county and household size.

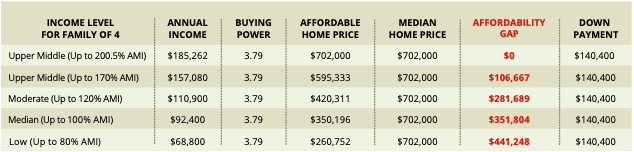

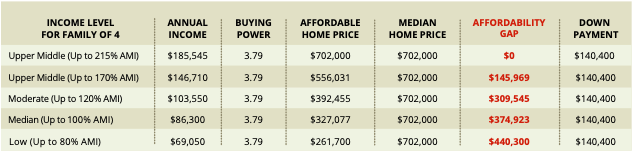

Significant Gaps Between Income Levels and Housing Prices

If housing is defined by HUD as affordable when no more than one third of a household’s income should be allocated towards housing, this means that the maximum sale price a household can afford is about 3.794 times their annual income and the down payment required to purchase the home will be equal to 20% of this affordable price to secure a fixed 4.0% interest rate.

Ownership Cost Assumptions (Source: 2016 BAE Housing Needs Assessment)

Based on these parameters, only households above Upper Middle income (earning greater than 195% of Nevada and Placer County’s area median income) would be able to afford the median sale price of $702,00 for a single-family home in Truckee without exceeding the 30% cost burden.

% of Income for Housing Costs

30% of Gross Annual Income

Down Payment

20% of Home Value

Annual Interest Rate

4%

Loan Term

30 Years

Upfront Mortgage Insurance

1.75% of Home Value

Annual Mortgage Insurance

0.85% of Mortgage

Annual Property Tax Rate

1.25% of Home Value

Annual Hazard Insurance

0.42% of Home Value

Affordability Gap for NEVADA County (as of October 2020)

A family of four earning 100% of the area median income (in Nevada County) could afford a $350,196 priced home, but this is nowhere near the median home price in Truckee of $702,000. The median for-sale single-family home price is almost double what a household earning the median area income can afford.

Affordability Gap for PLACER County

A family of four earning 100% of the area median income (in Placer County) could afford a $327,077 priced home, but this is nowhere near the median home price in Truckee of $702,000. The median for-sale single-family home price is almost double what a household earning the median area income can afford.

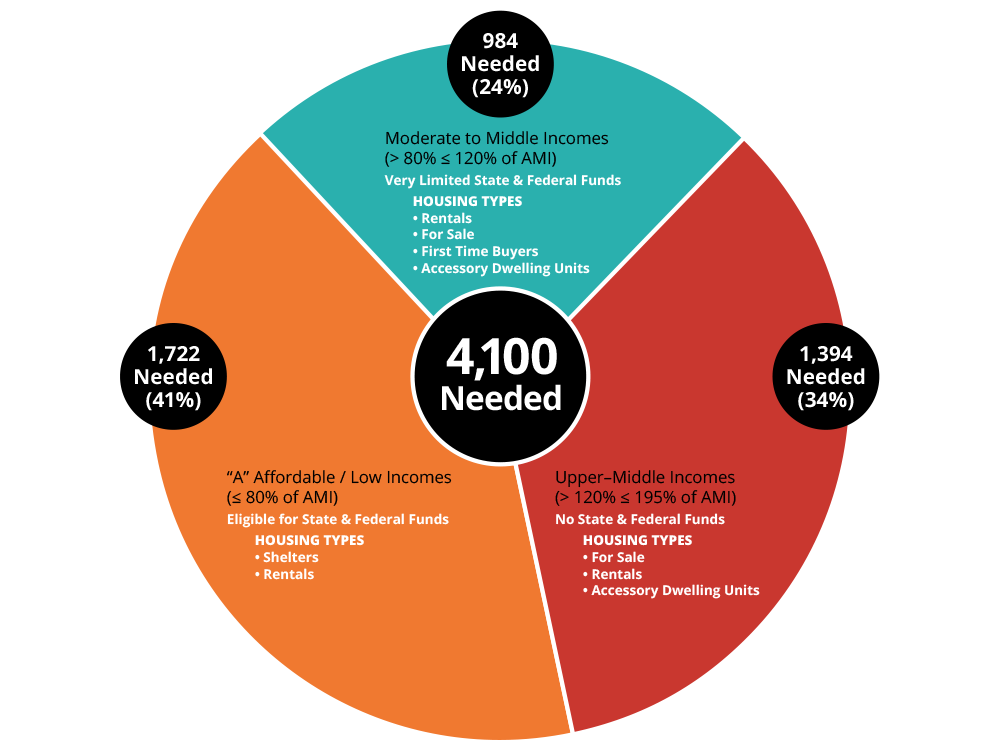

Workforce Housing Needs per Income Level

4,100 full-time employees in the North Tahoe-Truckee region are overpaying, living in overcrowded homes, etc. This number represents the total need or unmet demand estimate in our area. The number does not include seasonal or non-resident commuters which bumps the total need to over 12,000.

Unmet Housing Need of Year-Round Workforce

Source: 2017 BAE Housing Needs Assessment

Read the MHC Policy Paper on Achievable Local Housing.

Read and download other MHC Housing Reports and Policies.